As a matter of fact it does. So why continue reading this article if you already know the answer? Read on and learn why real estate investment works in Sweden.

- Historical data. Swedish real estate prices were far less volatile than, for instance, Norway and Holland between 1875 and 1957. However, since 1981 Swedish real estate values have consistently risen—even during 1991-1994 when economies around the globe suffered.Overall Swedish real estate value has increased 13.2% over the last 120 years. Between 1995 and 2011 real estate prices grew at the average rate of 5.7% annually. Compared even to the USA (0.4% annual increase 1892-2004), this is a surprisingly optimistic number!

- Big city power! Stockholm and Gothenburg are right now seeing tremendous growth rates. In 2014 and 2015, Stockholm has expanded its real estate worth by 17 %, Gothenburg 19%, and Sweden as a whole 14 %.

- Location, location, location! Since 2005 the magic number is (+) 61%! This increase in real estate prices is a reflection of a stable, growing economy.And most native Stockholmers would think the biggest increases are occurring in Östermalm, Kungsholmen or Djurholmen—but they’re not. They are taking place in Botkyrka, Vallentuna, Värmdö, Sigtuna and Ekerö. But the largest increase is seen in Nynäshamn—with a 156% increase over the last seven years!

- Population growth.The word “growth” doesn’t do justice here. Maybe “escalation” is a better description of what’s happening in Sweden— population escalation. Every day 100 people appears in Stockholm. Since 2013, Sweden’s general population has increased by roughly 1% annually. Just imagine 100 000 people arriving and settling into Sweden every year!This is an entrepreneur’s dream! Doesn’t everyone need a home? Although a large part of this “escalation” is due to the current conflict in some countries, a golden opportunity to invest in real estate is very real.

This is an opportunity to earn on a wise investment and chance to help!

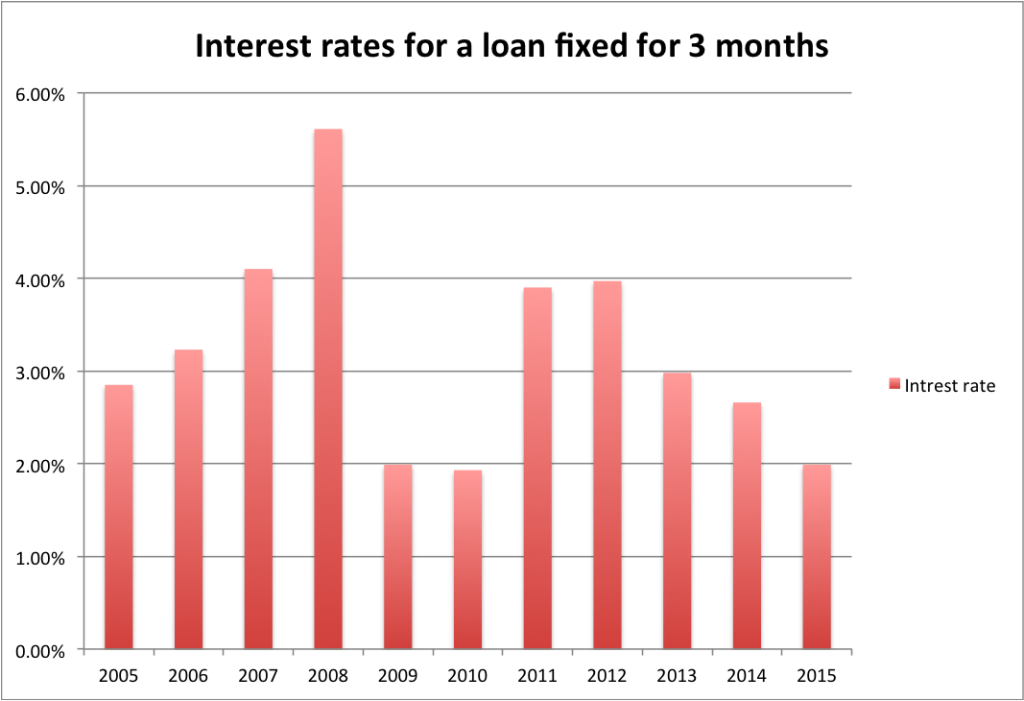

- Safe banking system. I wish one existed! But then again, everything is relative. Here are the statistics of interest rates for a loan fixed for 3 months in Sweden since 2005 (taken in the middle of June every year, source SEB)

Alexander Widegren, CEO of Lånbyte, a Swedish based technology company renegotiating debts and mortgages in the Nordics, suggested in 2014 to take five percent rent into account when investing in real estate. “If you could pay all fees when rents rise to 5%, you are safe.”

- A learning process. Who knows when the next financial crises will occur? The 1990-1994 crisis was caused by a number of factors: an unregulated credit market, rising debt within the private sector (85% to 135% (from 1985)).

Also, private savings had dropped by 7 percentage points against the GDP, and then turned negative, creating instability and vulnerability in Sweden’s economy. Add a high inflation rate, which was created by an overhauled currency, and we have a recipe for disaster.However, Sweden did learn by its mistakes and that is precisely why she was not hurt by the crises in 2008. Anders Borg, Minister of Finance, based his “Swedish perspective on the crisis of 2008” through experiences learned from the 1990’s.

Yes! It does work to invest in real estate in Sweden. But remember, INVESTING in real estate is different from buying yourself a home!

More about investing vs buying in our next article.

Pingback: Exit Strategies in Real Estate. Part I