Let’s admit it—financial education studies at school suck!

It doesn’t really matter which country you live in. Everywhere in the world, biology, history, and math are the main subjects in school. Such subjects as financial education and communication in society are not included in ordinary school curriculums. However, these two subjects are essential, and used in everyday life.

It doesn’t matter how old are you or how much are you earn, there is always the possibility to spend money wisely. Rethink your spending behavior in order to protect yourself, your future and your family.

Here are two books that I strongly recommend to everybody. It doesn’t matter if you have a financial education, or not.

I remember the feeling I had after reading this book at the age of 18. I felt like the biggest secret of the world was all of the sudden, revealed.

The book is very easy to read, the examples are easy to remember, but the idea of the book is worthless. Stay ahead forever!

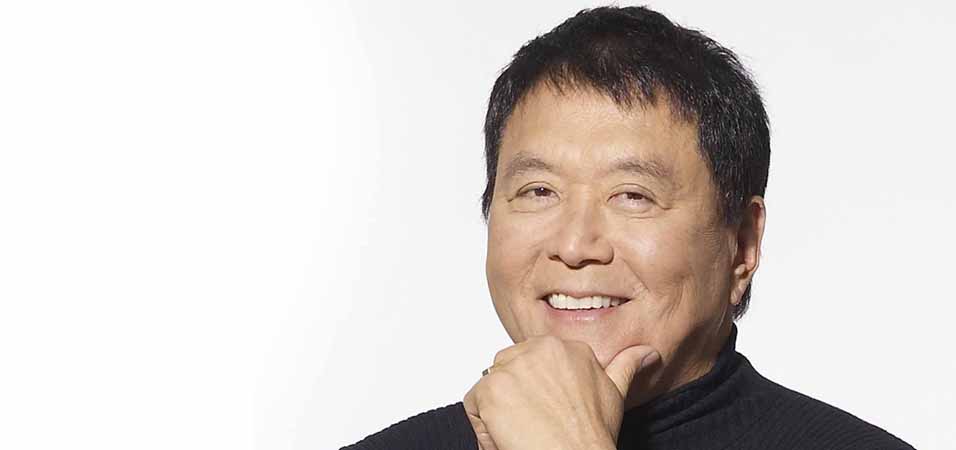

Even now, I remember the messages from Rich Dad, Poor Dad. Robert Kiyosaki repeats them several times throughout his book:

– If ‘the harder you work, the more you get’ formula is your philosophy, then you will never be rich in the end.

– Always question your spending habits: when you spend money on something, do you spend it on the things that will require you to spend even more later (like cars, for example) or are you wise with money, using it to bring more in the future (buying the apartment and rent it out).

– “You need to get an education, then go and find a stable job – this is the way to success and an independent financial future!” If somebody tells you this, laugh out-loud! This is one of the biggest myths ever created by society!

Rich Dad, Poor Dad has an entrepreneurial spirit. It engages you to think out-of-the-box and pay yourself first; taxes later.

The next book talks more about an “investment plan” for employees with emphasis on understanding the importance of discipline and understanding compound interest.

It is nicely written, and with a sense of humor. The Canadian author gives it away with the title—it does not matter what you do and how much money you earn, you have the same chances of being wealthy as anybody else. Most importantly, follow your financial plan no matter what.

David Chilton is not only a writer; he is also a successful investor. He can be seen making investment decisions at the Dragons’ Den Canada show (from 2012-present).

On a cozy weekend evening, make a cup of warm chocolate, sit on your favorite armchair and enjoy reading and learing…

(to be continued…)

Pingback: Nouveau maillot

Pingback: How does candy relate to your financial independence?

Pingback: Financially Fearless is a great financial education book by Alexa von Tobel, which is the perfect Christmas present under 12 $ for graduates.