Financial Education Books

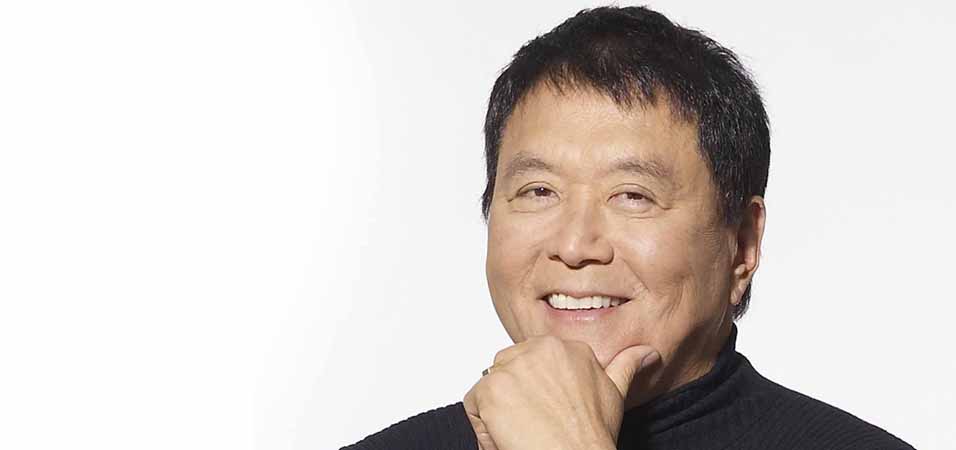

Let’s admit it—financial education studies at school suck! It doesn’t really matter which country you live in. Everywhere in the world, biology, history, and math are the main subjects in school. Such subjects as financial education and communication in society are not included in ordinary school curriculums. However, these two subjects are essential, and used in everyday life. It doesn’t matter how old are you or how much are you earn, there is always the possibility to spend money wisely. Rethink your spending behavior in order to protect yourself, your future and your family. Here are two books that I strongly recommend to everybody. It doesn’t matter if you have a financial education, or not. Rich Dad, Poor Dad by Robert T. Kiyosaki I remember the feeling I had after reading this book at the age of 18. I felt like the biggest secret of the world was all of the sudden, revealed. The book is very easy to read, the examples are easy to remember, but the idea of the book is worthless. Stay ahead …